45 perpetual zero coupon bond

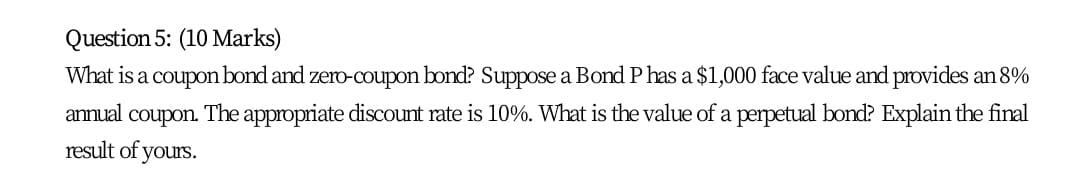

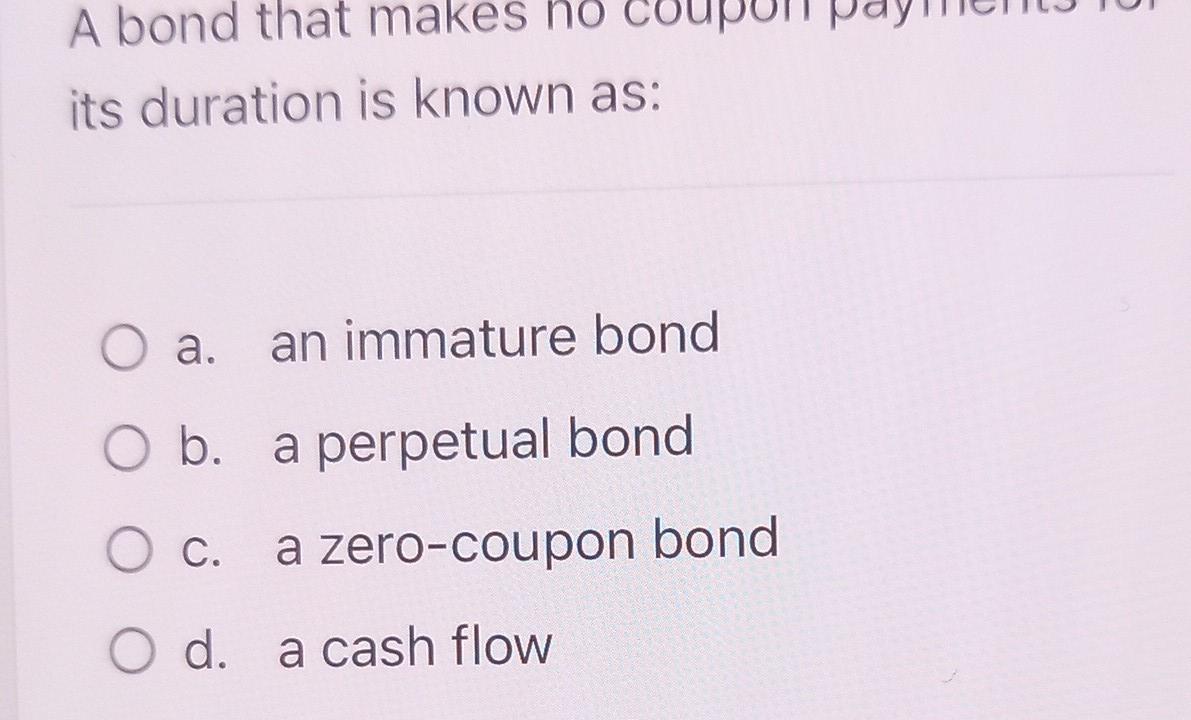

Impossible Finance — The Zero Coupon Perpetual Bond - Medium The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a... An Overview of Perpetual Bonds - Investopedia As an example, a bond with a $100 par value, paying a coupon rate of 5%, and trading at the discounted price of $95.92 would have a current yield of 5.21%. Thus the calculation would be as...

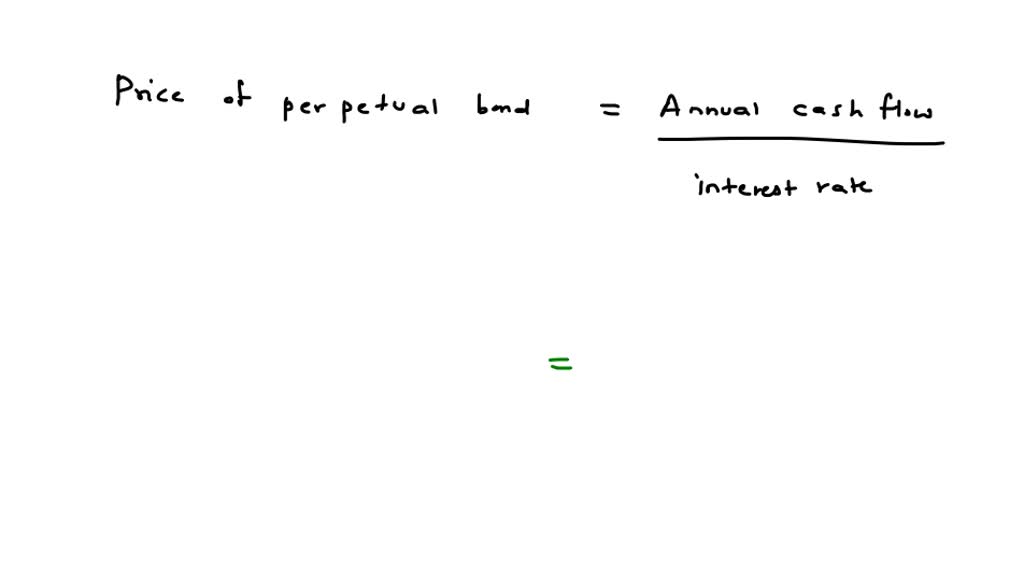

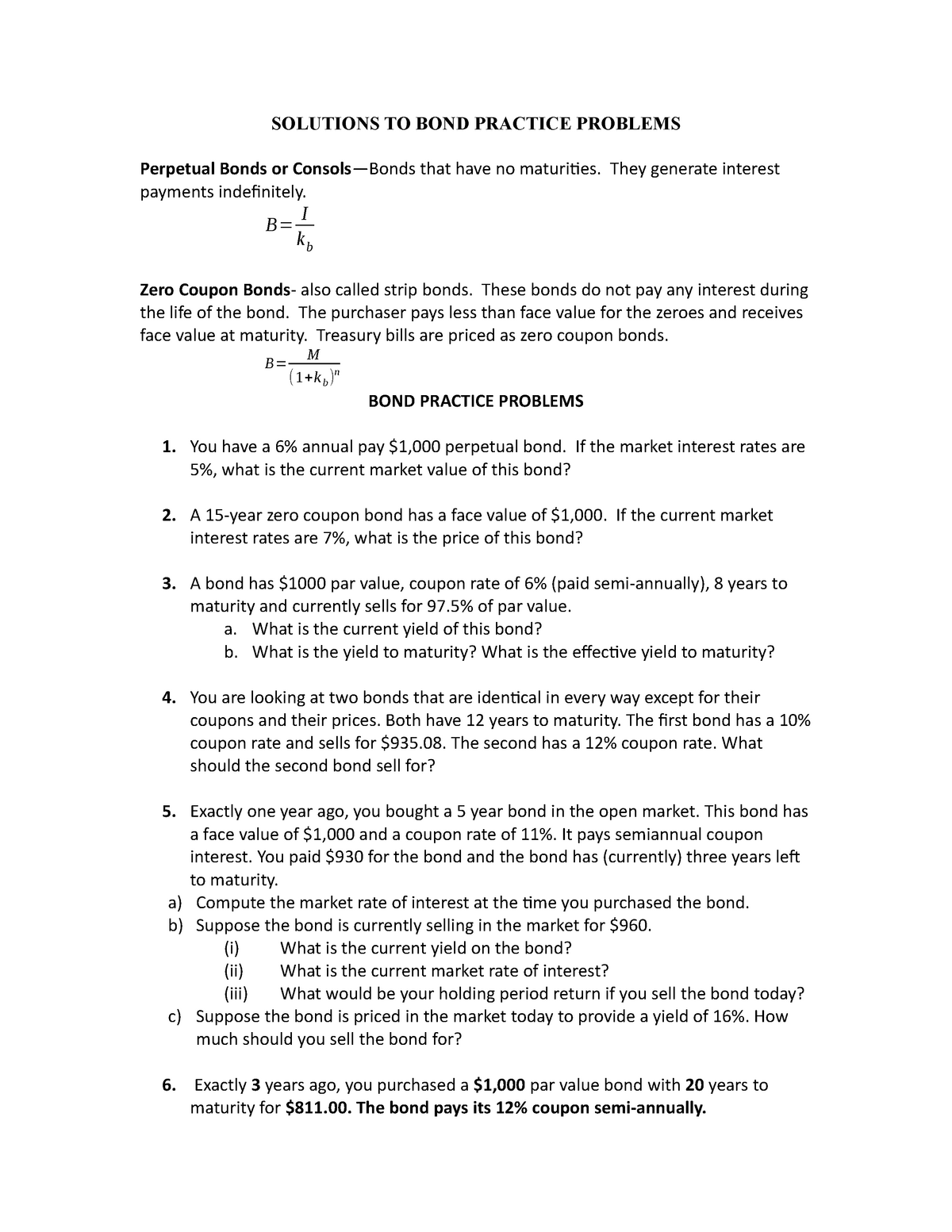

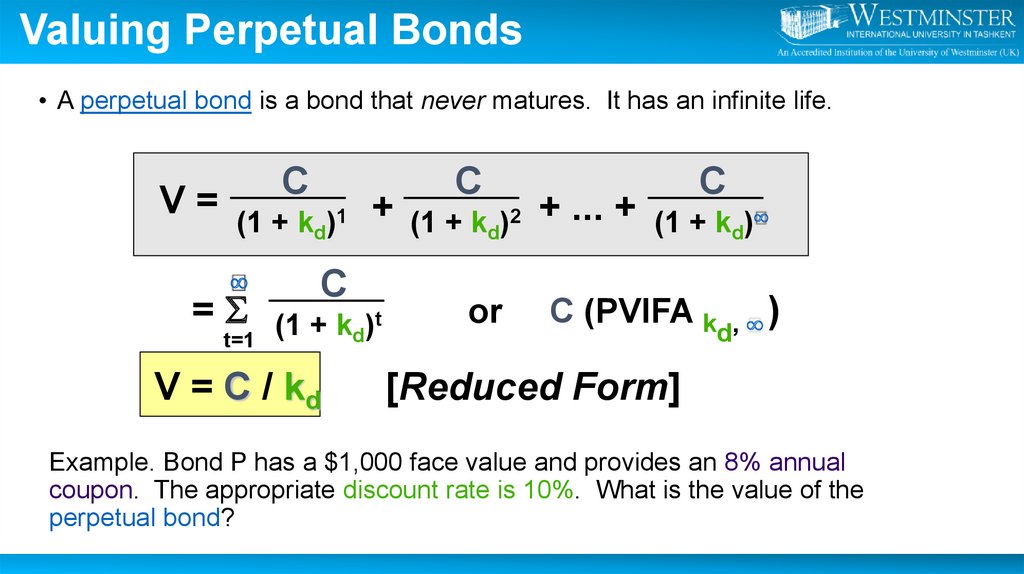

Perpetual Bonds - How Do They Work? - Accounting Hub The present value of perpetual bonds can be calculated with the present value formula of perpetuity. Present Value = D/r Where: D = annual coupon payment r= coupon rate (annual) For example, suppose a perpetual bond pays $ 50,000 in annual coupon payments and has a coupon rate of 5%. Present value = 15,000/0.05 = $ 300,000.

Perpetual zero coupon bond

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds... What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is...

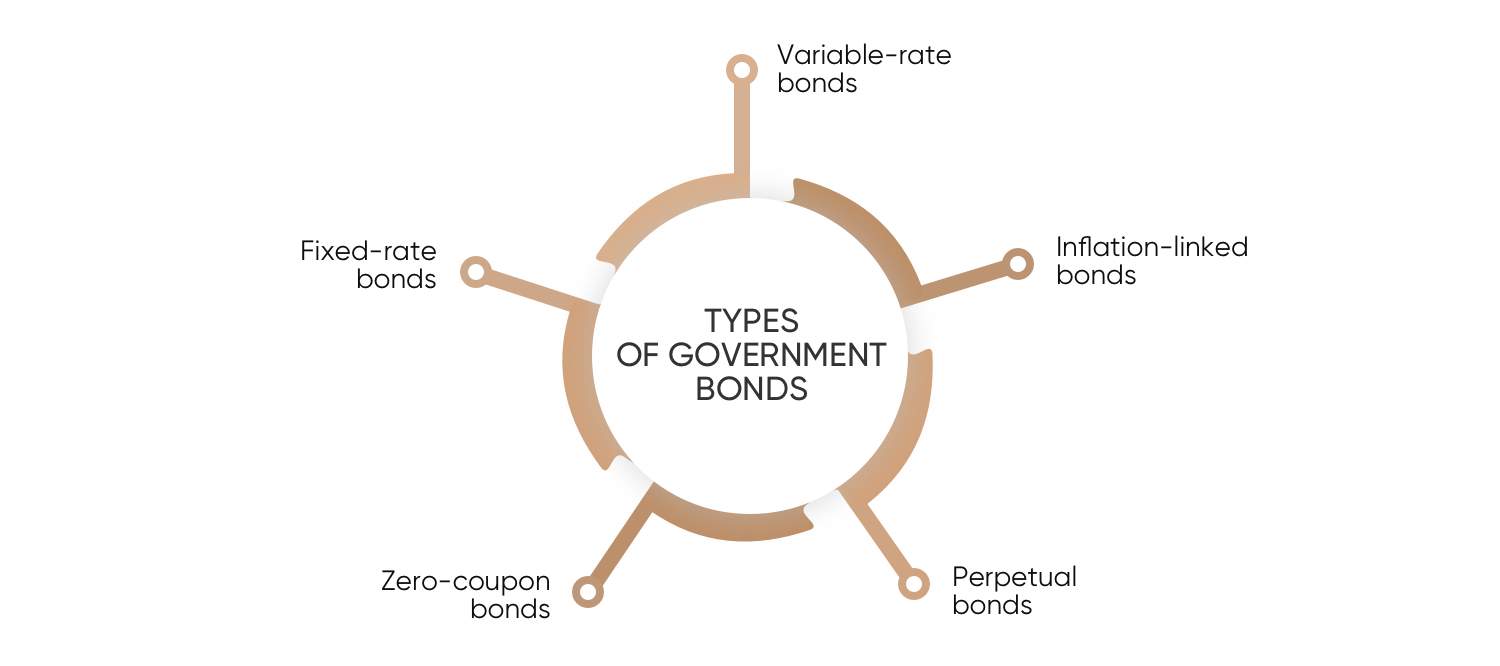

Perpetual zero coupon bond. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for... Perpetual Bond: Definition, Example, Formula To Calculate Value Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Perpetual bond - Wikipedia A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, [1] therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity . Contents

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 884 views View upvotes 11 Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation. Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha Zero coupon perpetual is sort of a financial oxymoron. This Barron's story notes that some of the conversation around helicopter money in Japan focuses on a zero coupon perpetual bond. Seeking ...

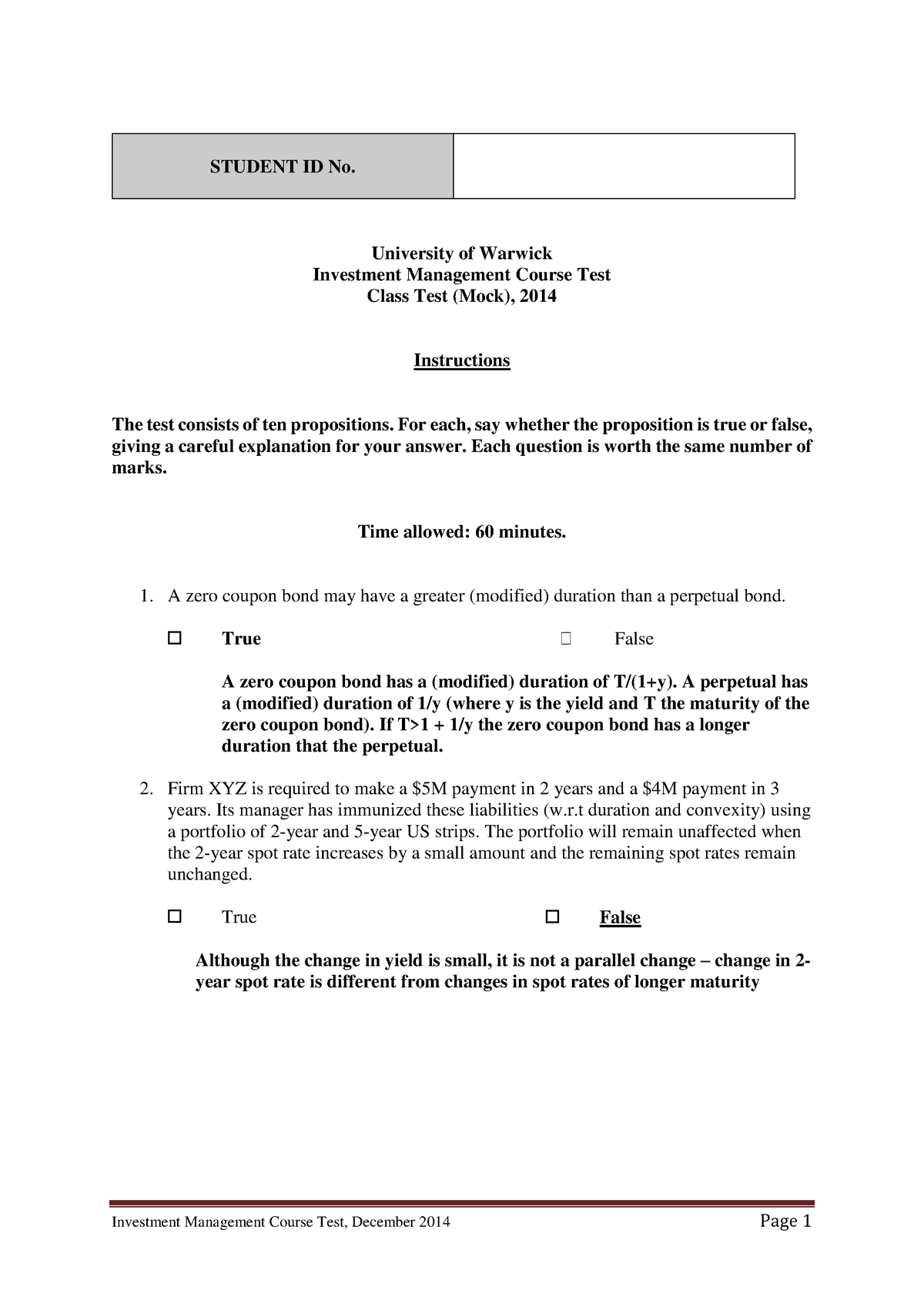

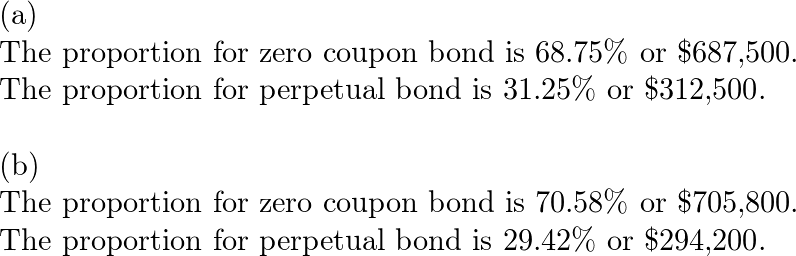

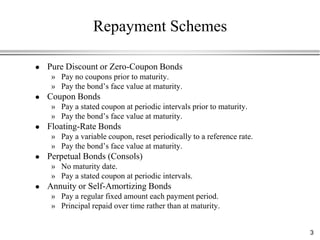

PDF Bonds - Finance Department » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals. Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall... What Is the Difference Between a Zero-Coupon Bond and a Regular Bond? Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

BOLI - The "Zero Coupon Perpetual Bond" - nfp.com BOLI - The "Zero Coupon Perpetual Bond" August 01, 2020 BOLI is a bond — a "zero coupon perpetual bond." What's fascinating about this bond is that neither ABC Insurance Company nor XYZ Insurance Company, the issuer, sets the price for the bond. It's really the federal government, as tax code (IRC 7702) sets the parameters for the price.

Zero-Coupon Bond - The Investors Book Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases. Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term.

Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

What is the difference between a zero-coupon bond and a regular ... - Quora Answer (1 of 6): Hello, The difference between a regular bond and a zero-coupon bonds, is that the former pays bondholders interest, while the latter does not issue such interest payments, otherwise known as coupons. Instead, zero-coupon bondholders merely receive the face value of the bond when...

All the 21 Types of Bonds | General Features and Valuation | eFM Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). ... Perpetual Bonds. Perpetual bonds are types of bonds that pay a coupon rate on the face value till ...

Is fiat currency the same as a perpetual zero coupon bond? Answer (1 of 4): representative money, like gold standard money, can be considered a debt in that the hold is owed that amount of gold and a bond is something one is paid an increased value on over time if with the gold standard there is still inflation, which there usually was, then as the val...

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... A zero-coupon bond is a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings

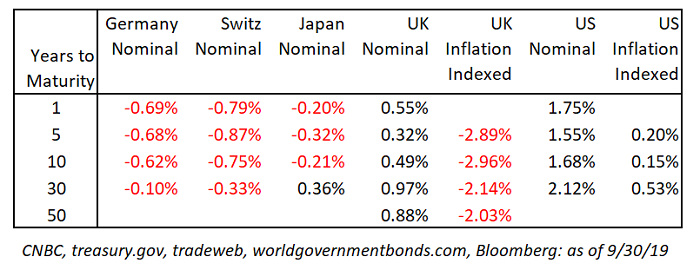

The British Government issued perpetual bonds in 1821 with a coupon rate of 3% and face value of £100. Calculate the price of such a bond in 2008 when the riskless interest rate in London is 4.85%.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is...

Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

Post a Comment for "45 perpetual zero coupon bond"