42 formula for coupon payment

Accrued Interest Formula | Calculator (Examples with Excel ... Most recent payment should be on Jan 1 st. so No of days from most recent payment is 31 days for Jan, 28 days for Feb, 5 days in March = 31+28+5 = 64. Time of the Accrued Interest is calculated using the formula given below. Time of Accrued Interest = Interest Rate / Payment Frequency What is a Coupon Payment? - Definition | Meaning | Example Despite the attractive return, he decides to purchase $10,000 of the US Treasury Bond. Now, how will this affect his $10,000 principal? Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall.

How to use the Excel COUPNCD function | Exceljet Below is the formula in F6 reworked with hardcoded values and the DATE function: = COUPNCD (DATE (2019, 2, 15), DATE (2024, 1, 1), 2, 0) ... The Excel COUPNUM function returns the number of coupons, or interest payments, payable between the settlement date and maturity date.

Formula for coupon payment

Loan Payment Formula (with Calculator) - finance formulas The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of. Return to Top What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula. The coupon rate calculations formula is simple. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Formula for coupon payment. Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. How to use the Excel COUPNUM function | Exceljet In Excel, dates are serial numbers . Generally, the best way to enter valid dates is to use cell references, as shown in the example. To enter valid dates directly, you can use the DATE function. Below is the formula in F6 reworked with hardcoded values and the DATE function: = COUPNUM(DATE(2019,2,15),DATE(2029,1,1),2,0) Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Current Yield Formula | Calculator (Examples with Excel Template) Annual Coupon Payment = 7% * $1,000; Annual Coupon Payment = $70; For Bond 2. Annual Coupon Payment = 8% * $1,000; Annual Coupon Payment = $80; Current Yield of a Bond can be calculated using the formula given below. Current Yield = Annual Coupon Payment / Current Market Price of Bond

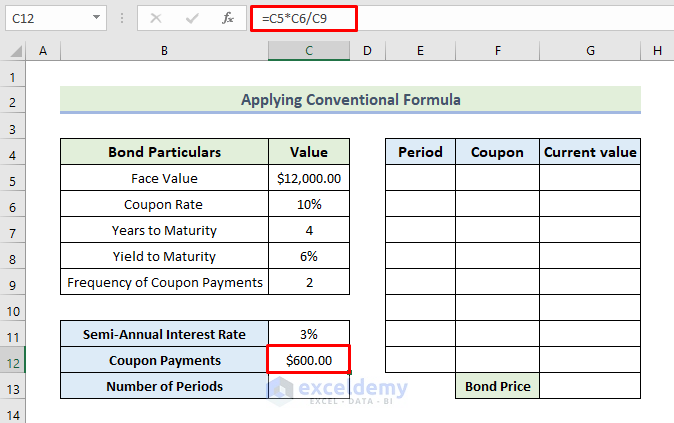

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. ... › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × ... Bond Coupon Payment Formula - bizimkonak.com Coupon Payment Definition, Formula, Calculator. CODES (1 days ago) WebFormula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, … Visit URL. Category: coupon codes Show All Coupons Coupon Rate Formula & Calculation - Study.com A coupon rate, or the coupon payment, refers to the fixed interest payment paid by bond issuers to bondholders. Usually, bonds offer coupon payments that are paid semiannually and have a par, or ... Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

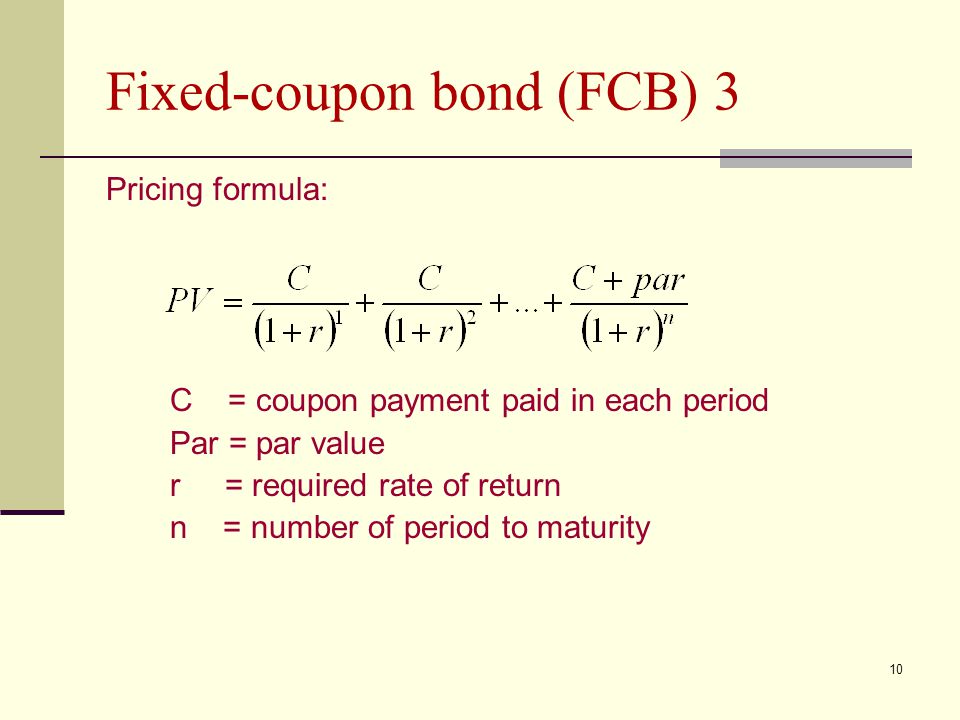

Bond Pricing - Formula, How to Calculate a Bond's Price The number of periods will equal the number of coupon payments. The Time Value of Money Bonds are priced based on the time value of money. Each payment is discounted to the current time based on the yield to maturity (market interest rate). The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of... How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid COUPDAYS Function - Formula, Examples, How to Use The COUPDAYS function helps in calculating the number of days between a coupon period's beginning and settlement date. Formula =COUPDAYS (settlement, maturity, frequency, [basis]) The COUPDAYS function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security.

Coupon Payment | Definition, Formula, Calculator & Example Formula Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037.

Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Coupon Rate (C) – This is the periodic payment, usually half-yearly or yearly, given to the purchaser of the bonds as interest payments for purchasing the bonds from the issuer. The bond prices are then calculated using the concept of Time Value of Money wherein each coupon payment and subsequently, the principal payment is discounted to ...

Free Baby Formula Samples & Coupons | Enfamil Discover the benefits of Enfamil Family Beginnings! Get up to $400 in free gifts, baby formula coupons, samples, special offers and other savings.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

Coupon Bond - Guide, Examples, How Coupon Bonds Work n = number of payments. Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources. Thank you for reading CFI's guide on Coupon Bond.

Coupon Definition - Investopedia Coupon rate or nominal yield = annual payments ÷ face value of the bond Current yield = annual payments ÷ market value of the bond The current yield is used to calculate other metrics, such...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Examples of Coupon Bond Formula (With Excel Template) Let's take an example to understand the calculation of Coupon Bond in a better manner.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Rate: Definition, Formula & Calculation - Study.com C = i / p where: C = coupon rate i = annualized interest (or coupon) p = par value of bond Coupon Rate Calculation Example Let's look at an example. XYZ Company, the fictitious maker of...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

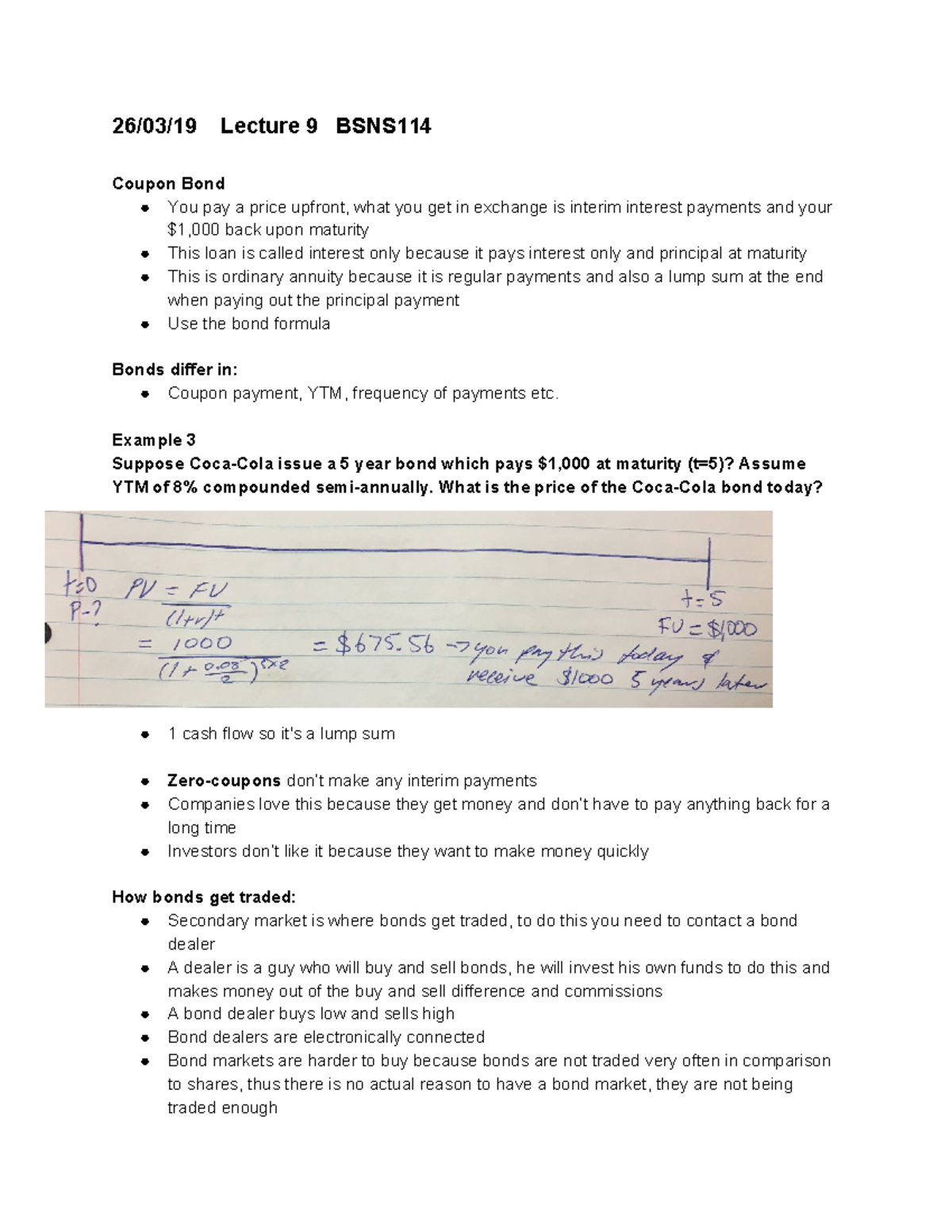

Time value of money - Wikipedia A typical coupon bond is composed of two types of payments: a stream of coupon payments similar to an annuity, and a lump-sum return of capital at the end of the bond's maturity—that is, a future payment. The two formulas can be combined to determine the present value of the bond.

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent.

Annuity Payment | Formula, Example, Conclusion, Calculator Annuity Payment Example. Let's say you have an annuity which pays out a cash flow of $1,000 every year for the next five years, and you invest each payment at 5% interest rate. We can work out both the present and future value of this annuity. The present value of this annuity in today's money is $4,329.48. Let's take a look at the future ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula. The coupon rate calculations formula is simple.

Loan Payment Formula (with Calculator) - finance formulas The payment on a loan can also be calculated by dividing the original loan amount (PV) by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of. Return to Top

Post a Comment for "42 formula for coupon payment"