38 bond coupon interest rate

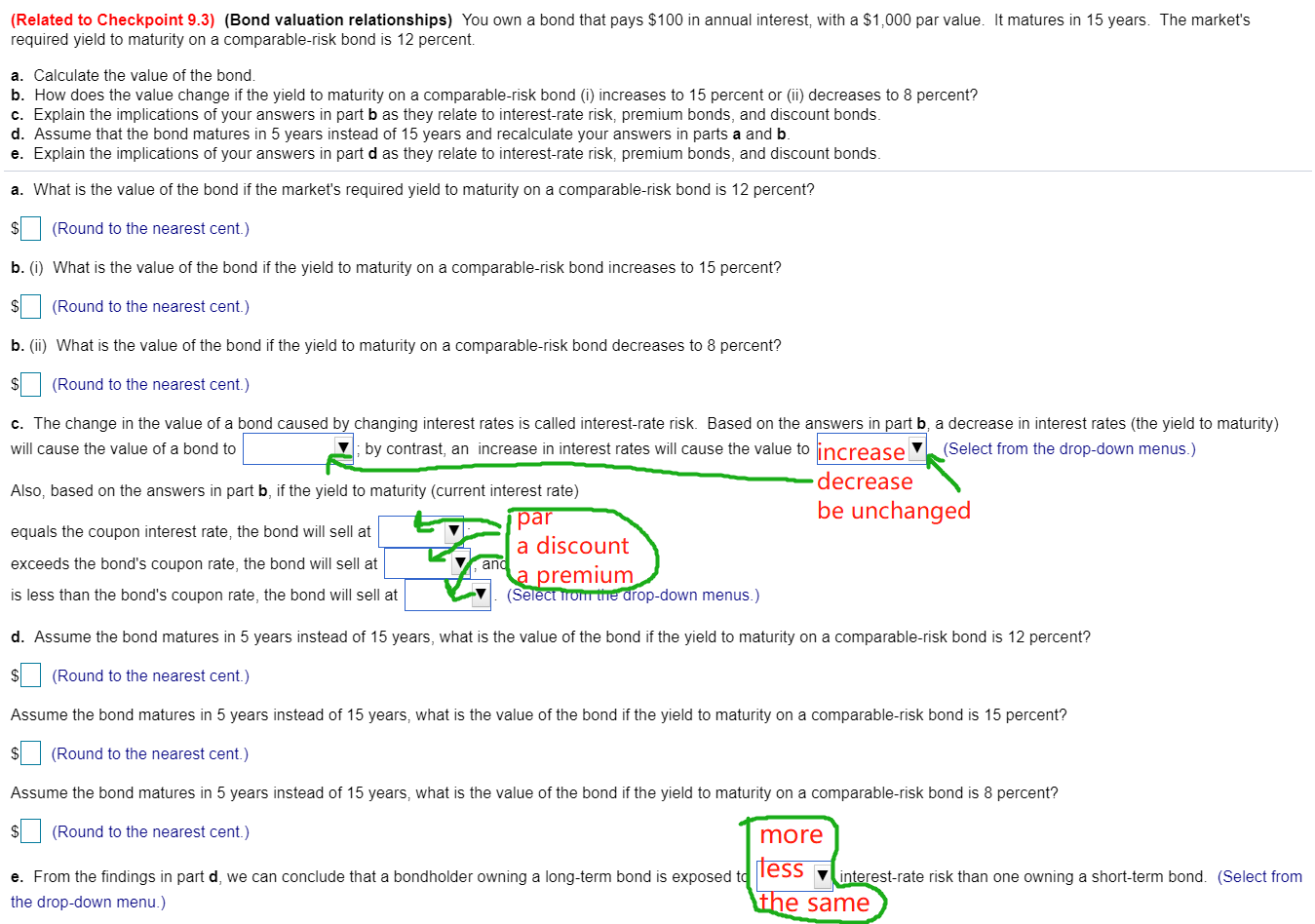

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount ... Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, ... Interest rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, ...

Interest Rate Risk Definition and Impact on Bond Prices Sep 25, 2022 · Interest Rate Risk: The interest rate risk is the risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape ...

Bond coupon interest rate

What Is a Bond Coupon? - The Balance 4.3.2021 · The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal ... Why Do Bond Prices Go Down When Interest Rates Rise? - The … Feb 16, 2022 · The bond has a 3% coupon (or interest payment) rate, which means that it pays you $30 per year. If you’re paid every six months, you’ll receive $15 in coupon payments. Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%. Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

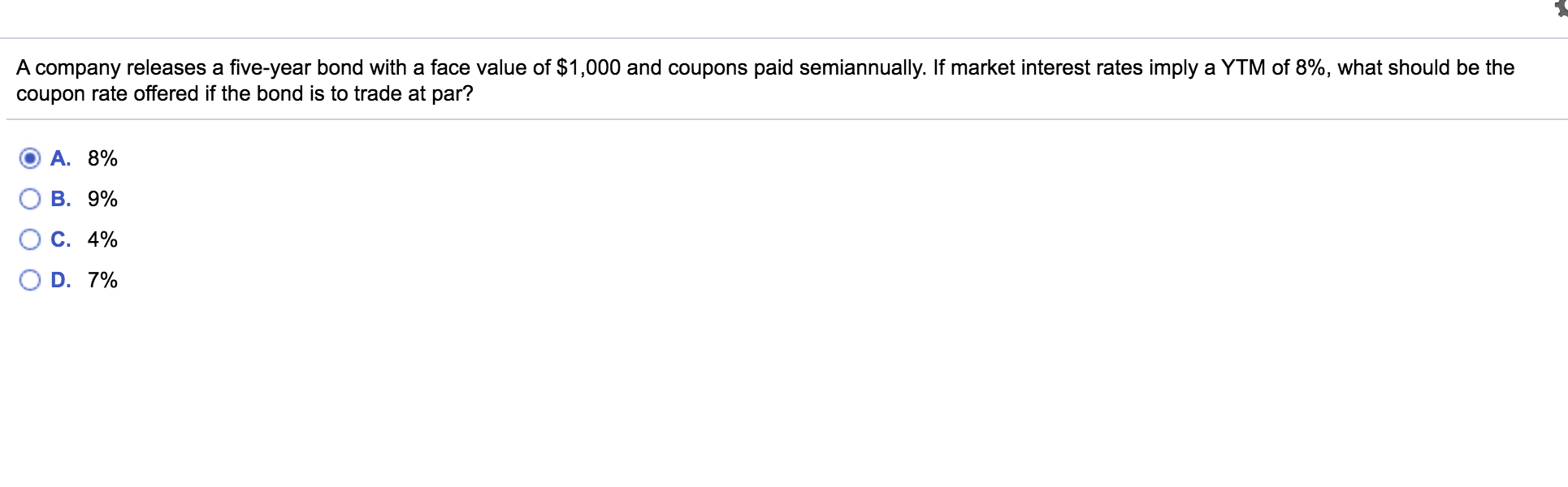

Bond coupon interest rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

How to Calculate an Interest Payment on a Bond: 8 Steps 10.12.2021 · Multiply the bond's face value by the coupon interest rate. By multiplying the bond's face value by its coupon interest rate, you can figure out what the dollar amount of that interest rate is each year. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out exactly how much ... Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Why Do Bond Prices Go Down When Interest Rates Rise? - The … Feb 16, 2022 · The bond has a 3% coupon (or interest payment) rate, which means that it pays you $30 per year. If you’re paid every six months, you’ll receive $15 in coupon payments. Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%. What Is a Bond Coupon? - The Balance 4.3.2021 · The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest payments. Zero-coupon bonds don't pay interest. They instead mature to a value greater than the principal ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "38 bond coupon interest rate"