40 zero coupon bond price calculation

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula. Sale Price = FV / (1 + IR) N. Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ...

Zero Coupon Bond Value - Formula (with Calculator) After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining …

Zero coupon bond price calculation

Zero Coupon Bond Calculator 05.01.2022 · Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. Zero Coupon Bond Calculator – What is the Market Price? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months; Substituting into the formula: What is a Zero Coupon Bond? - ICICIdirect Pricing of a Zero Coupon Bond . The formula used to calculate the price of zero-coupon bonds is: Price = Face Value/ (1+r)^n . Where r is the annual return, and n is the number of years until maturity. Why invest in a Zero Coupon Bond 1. Returns are predictable . The most significant advantage of a zero-coupon bond is that the returns that you ...

Zero coupon bond price calculation. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Zero Coupon Bond - Explained - The Business Professor, LLC ZeroCouponBond: Zero-Coupon bond pricing in RQuantLib: R Interface to ... The ZeroCouponBond function evaluates a zero-coupon plainly using discount curve. More specificly, the calculation is done by DiscountingBondEngine from QuantLib. The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For more detail, see the source code in the QuantLib file test-suite/bond.cpp . Zero-Coupon Bond Definition - Investopedia 31.05.2022 · The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax...

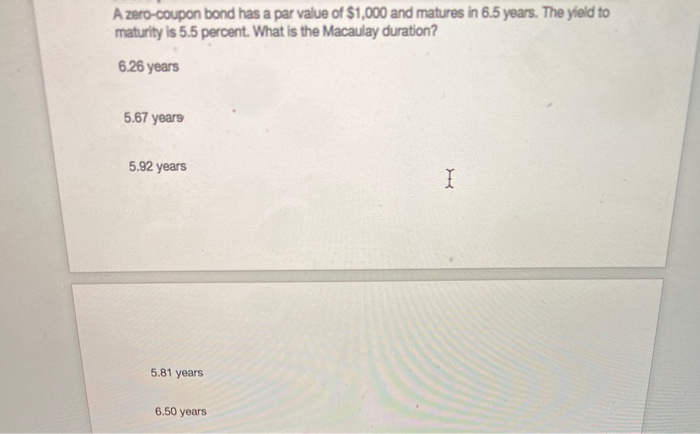

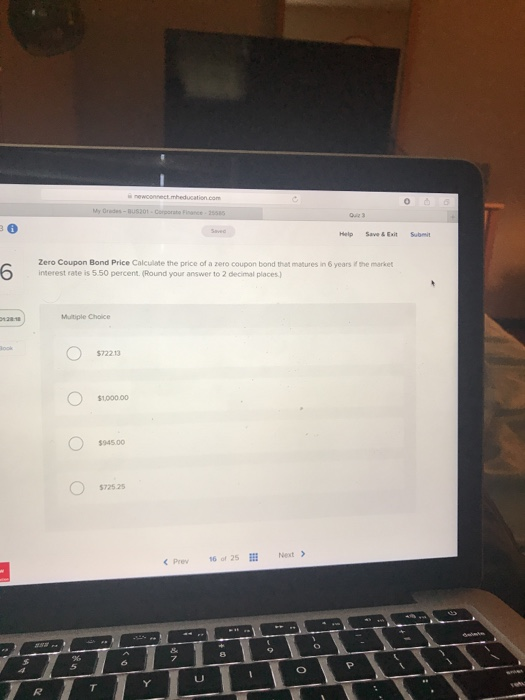

Zero Coupon Bonds: Calculating Price, Interest, and Value The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. The bond's duration is 3.6481 years. You expect that interest rates will fall by .3% later today. * Use the modified duration to find the approximate percentage change in the bond's price. Zero Coupon Bond Calculator Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. Zero Coupon Bond: Calculate the YTM (yield to maturity) Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the bond is currently trading for $459, what is the yield to maturity on this bond? Show calculations. Please show all calculations with. What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity ... Most zero-coupon bonds compound semiannually, so the second formula is more applicable for general calculation ...

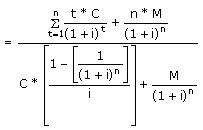

Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: Zero-Coupon Bond - Definition, How It Works, Formula Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the ... Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

What Is A Coupon Value? Definition And Calculation A zero-coupon rate bond does not pay an annual coupon rate It has longer maturity dates and greater volatility but sells for a discount An entity sells a 20-year zero-coupon rate bond at $5,000

Zero Coupon Bond Yield: Formula, Considerations, and … 09.03.2022 · The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

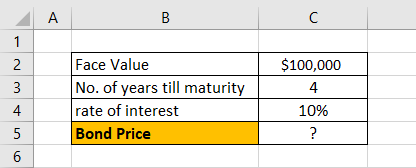

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Example 2. Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8.

Zero Coupon Bond (Definition, Formula, Examples, …

Zero Coupon Bond Yield: Formula, Considerations, and Calculation Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [{F/PV}]^(1/t) =1+r. Where. F -face value of the bond. PV- current value of the bond. t -time to maturity. r- Interest rate. For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of ...

Zero-Coupon Bond: Formula and Excel Calculator If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula. Price of Bond (PV) = FV / (1 + r) ^ t; Where: PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

What Is Dirty Price? - thebalance.com Corporations in the U.S. often calculate bond interest as accruing over 30 days in a month and 360 days in a year, which is known as a 30/360 day-count convention. ... Because there's no interest accruing for a zero-coupon bond, the clean price and dirty price are the same.

ASSIGNMENT | How do you calculate the price of a coupon bond from the ... The Price of a Coupon Bond from The Prices of Zero-Coupon Bond Most bonds make interest payments on periodic basis during the life of the bond. The principal is then returned when the bond matures. However, zero-coupon bonds do not make any payments.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

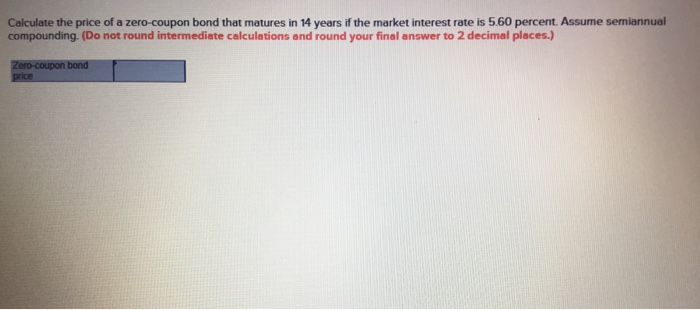

Quant Bonds - Zero Coupon - BetterSolutions.com What is the price of a zero coupon bond that matures in 10 years. 1) Calculate the number of periods To make this consistent with the equation for coupon paying bonds the number of periods will be (10 * 2) = 20. 2) Calculate the semi-annual interest rate the semi annual interest rate will be 8.6/2 = 4.3. bond price = 1000 / (1 + 0.043)20

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

How to Calculate a Zero Coupon Bond Price - Double … 16.07.2019 · The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Bond price - what it is, types, formulas for calculation P is the current price of the bond; H is its face value; i — percentage discount rate (in fractions of units, that is, for example, 12% = 0.12); t is the number of days to maturity. You do not have to calculate the current price, since this is the quote, it is reflected in the Quik trading terminal. Features of bond valuation Zero Coupon

Post a Comment for "40 zero coupon bond price calculation"